Resources > Blog > 40> End-to-End AP Automation Solution For Your Business

End-to-End AP Automation Solution For Your Business

What Is AP Automation?

AP automation involves using technology to digitize and streamline the entire process from invoice receipt to payment. Instead of manual tasks like data entry, verification, and approval, an intelligent software system handles these steps. Modern solutions also integrate AI and machine learning to detect discrepancies, prevent fraud, and deliver real-time reports.

Specific Benefits for Businesses

Cost Reduction

According to PYMNTS, upgrading to automated solutions can save companies approximately 11% of wasted costs. AP automation reduces expenses by minimizing the labor costs associated with manual processes.

Implementing an automated accounts payable process allows businesses to monitor and identify suppliers with strong relationships through reporting metrics. Once these suppliers are recognized, companies can negotiate extended credit terms or better discounts.

Reducing Payment Risks and Enhancing Control

Duplicate Payments:

Payment Fraud:

A PWC survey reveals that 31% of invoice fraud cases are committed by employees, while 26% involve collusion with third parties. Most fraud vulnerabilities stem from the inherent disorder in decentralized AP processes. These gaps arise when invoices are paid by multiple employees or across various departments.

With AP automation, invoices go through an online workflow, giving managers complete visibility into payments at every stage. This visibility, supported by accounting solution, enables them to easily spot suspicious transactions and require necessary verifications before any fraudulent payments are disbursed.

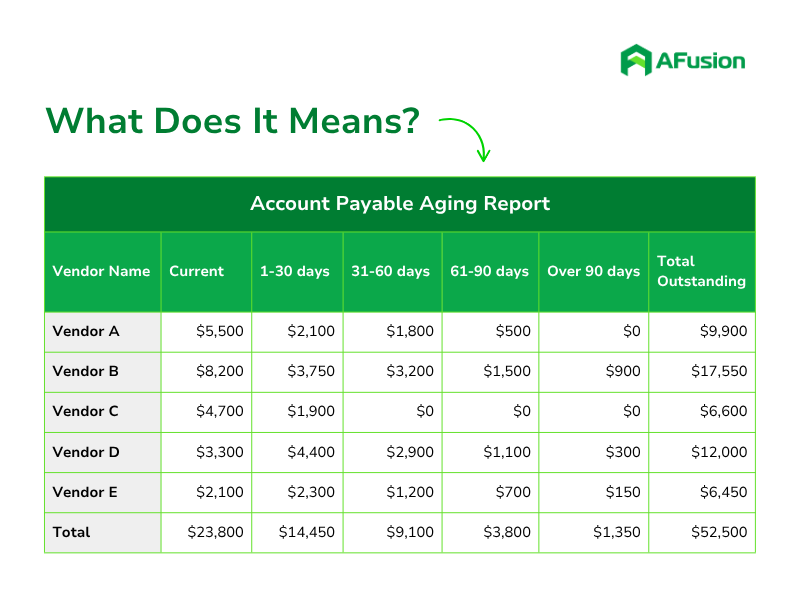

Moreover, improved visibility, enhanced by invoice automation, helps businesses understand their true payables balance, enabling them to consider strategic options moving forward.

Time Savings

AP Automation saves time and boosts efficiency by digitizing every step of the payment process. Instead of manual tasks like invoice data entry, printing checks, or waiting for individual approvals, everything is handled automatically via the system.

This allows finance teams to focus on strategic tasks that add greater value to the business. Simultaneously, organizations can handle more transactions without increasing staff, thanks to invoice automation, which also eliminates the recruitment cycle caused by employees leaving due to frustration with monotonous, exhausting manual work.

How Does AP Automation Work?

- Invoice Collection and Extraction Invoices are received in various formats like email, PDF, XML, and images; types include PO and non-PO invoices, delivery notes, and goods receipt forms, often in multiple languages. AI Agents with IDP technology extract accurate data from both headers and line items. Duplicate invoices are flagged instantly to prevent repeated payments.

- Data Validation and Matching The system automatically performs 2-way or 3-way matching of invoices with purchase orders (POs), delivery receipts, and contracts. Invoices outside tolerance thresholds are flagged for exception handling, reducing errors and ensuring accuracy.

- Flexible Invoice Approval Valid invoices are routed through an automated approval process based on company-defined rules. Approvers can act anytime, anywhere. Security measures like role-based access, two-factor authentication, and dual approval enhance safety.

- ERP Data Synchronization Post-approval, invoice data is synced in real-time with the accounting ERP system, ensuring consistency, accuracy, and audit readiness.

- Automated Payment Scheduling and Notifications The system schedules payments based on business needs, preventing late payments and errors while optimizing cash flow and maintaining good supplier relationships.

- Easy Storage and Auditing All processing, approval, and payment steps are recorded, stored, and categorized in a centralized data repository, ready for internal or external audits.

Which Industries Are Applying It?

Numerous industries are leveraging the benefits of AP automation solutions. Primarily, businesses handling large volumes of invoices and payments use AP automation to streamline their entire process.

According to Grand View Research, the accounts payable automation market spans various sectors:

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Goods and Retail

- Healthcare

- Information Technology and Telecommunications

- Manufacturing, Energy, and Utilities.

Why Should Organizations Automate Accounts Payable with AFusion?

Customized Process Design for Your Business

Adopting an automation solution can face obstacles. First, directors and employees may resist change, fearing it will complicate their work. Moreover, any workflow adjustment requires retraining and an adaptation period.

Second, integration challenges arise. ERP systems are company data hubs, and not all integrations are identical. Businesses must carefully assess whether a solution syncs well with existing tools.

AFusion’s accounts payable automation confidently addresses these two major issues. With over 15 years of experience, we tailor solutions to your current processes, ensuring minimal or no disruption post-integration.

End-to-End Solution

While traditional manual approaches to accounts payable are time-consuming, tedious, and error-prone, automation elevates efficiency to a new level. It streamlines the AP process from invoice collection to payment processing – all while integrating with your existing ERP system. Automated accounts payable also offers centralized visibility and control over the entire process, reducing fraud risks, improving cash flow management, and boosting organizational efficiency.

Though AP automation can automate the entire workflow, certain high-priority tasks benefit most:

- Data Entry and Invoice Extraction: This manual task is time-intensive and demotivating. Automated invoice data entry eliminates the tedious task of manually coding invoices into accounting systems, reducing error risks. AFusion’s integration with ERP streamlines data transfer, removing manual uploads. Top-tier tools achieve 99% accuracy, saving over 75% of time and accelerating month-end closings.

- Invoice Approval and Matching: Invoices from diverse sources (email, mail, fax, portals) complicate manual matching. This is already time-consuming, but errors double the effort with corrections before approval. AP automation ensures accurate matching, speeding up the approval process.

Standout Multilingual IDP Technology

AFusion delivers an ideal AP automation solution with iAutobot – a tool integrating IDP technology with LLM. This system accurately extracts data from multi-format invoices like PDFs, scanned images, or e-invoices, saving processing time and minimizing manual errors.

A key highlight is AFusion’s multilingual support, covering Vietnamese, Thai, Japanese, Chinese, English, Lao, Khmer, and more. This is especially valuable for businesses in Southeast Asia with multinational supply chains, breaking language barriers and ensuring flexibility and efficiency in financial processes.

Successfully Deployed for Major F&B Chains

AFusion is a multi-industry automation solution designed for digital transformation. With deep integration and smart automation, it has helped large businesses reduce invoice processing time from days to minutes while standardizing processes and optimizing operational costs.

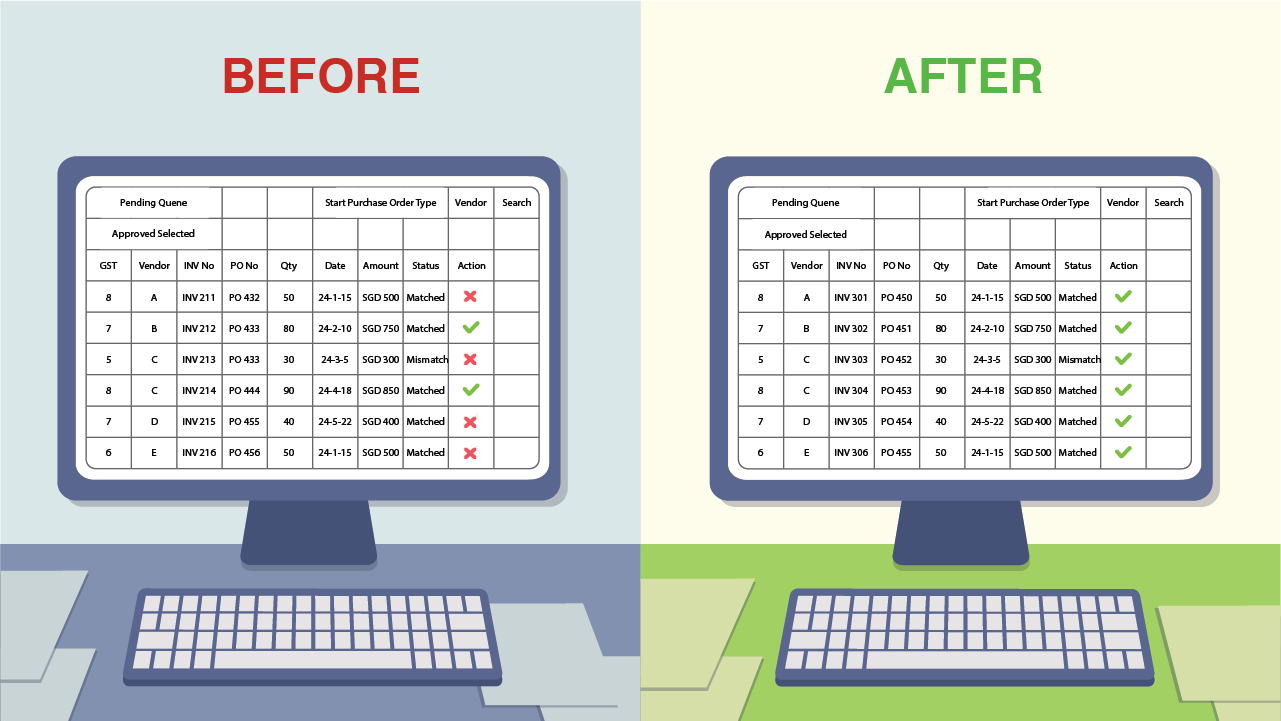

Notably, the F&B chain HC Coffee Vietnam now processes over 600 invoices quickly, saving over 90% of manual work through automated accounting. At Vistra Thailand, the AI Agent iAutobot uses IDP and LLM to extract, categorize invoice data, generate upload files, send email notifications, and integrate directly with D365 ERP. This ensures consistency and timely error detection before accounting entry, with businesses noting a clear difference pre- and post-implementation.

Pricing for AP Automation Solutions

At AFusion, we offer a transparent SaaS model based on the monthly invoice volume your business handles. Upon implementing AFusion, you pay a one-time setup fee covering system integration and connection to your existing accounting software. Subsequently, you’ll pay a flexible monthly or annual fee, adjusted according to invoice volume and usage.

As processing needs grow or change, we collaborate to adjust contracts – no unexpected cost overruns. Ready to transform your financial process? Contact AFusion now for a personalized quote and demo tailored to your business.

Final Thoughts

Choosing the right solution not only improves processes but also marks a pivotal shift for businesses in the digital era. In accounts payable, prioritizing digitization from invoice intake builds a fully automated, seamless workflow. This is a must-have solution to optimize time, resources, and drive sustainable growth.

Start your digital transformation journey today with AFusion to turn your finance department into a hub of efficiency and innovation. Contact us!

Previous Post

Previous Post Next Post

Next Post