Resources > Blog > 43> Invoice Tracker During Peak Season: F&B Solutions

Invoice Tracker During Peak Season: Solutions For F&B Businesses

The second half of the year is often the time when businesses accelerate their sales strategies to meet revenue targets. The F&B industry is no exception, as it continuously launches various promotional programs to boost product consumption. As a result, the number of sales invoices, purchase invoices from suppliers, and short/long-term contracts suddenly increases dramatically. This causes the volume of invoices during the peak season to become overwhelming and difficult to manage.

Meanwhile, the number of accounting staff usually remains unchanged and does not increase in proportion to the seasonal workload. This leads to accounting teams becoming overloaded, constantly having to work overtime-daytime is not enough, so they work at night just to try to keep the invoice tracker tool under control.

Invoice tracker during peak season becomes a major pressure, even a “nightmare” for accounts payable accountants. A non-optimized tracking process can easily lead to a series of difficult-to-handle problems:

- Accountants are unable to clearly determine which invoices have been paid and which haven’t, resulting in cash flow losses or duplicate payments to suppliers. Even worse, such negligence can be exploited by fraudsters to siphon off money unnoticed, making it hard for the business to detect in time.

- Accounts payable is not tracked on time, causing payment delays and damaging the company’s reputation and relationships with suppliers.

- Invoices are easily overlooked or lost if there is no centralized and well-organized storage and management system.

- Poor invoice tracking causes the debt collection department to always be in a passive state, negatively affecting the financial health and cash flow of the business

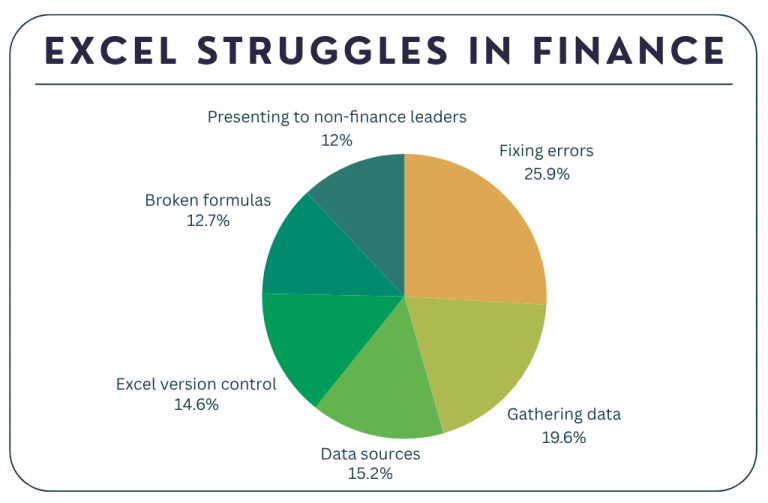

Insights from F&B businesses show: “At year-end, our order volume triples, but accounting staff can’t keep up. Some invoices go unpaid for more than three weeks simply because we forgot to remind the customer. We realized that tracking invoices with Excel is no longer suitable.” Similarly, a CFO report also indicated that 53% of financial and accounting leaders complain that the lack of automation is hurting their productivity because they waste time on manual, repetitive tasks.

The peak season should be a golden opportunity for businesses to grow and break through, but if invoice tracker and accounts payable processes are not properly managed, it turns into a period full of risks and pressure. The first ones to suffer are the accounting staff—those who work overtime day and night to “patch the holes” in the process.So the picture of the current situation is clear-but where is the flaw, and how can it be addressed quickly? Let’s dive into the details in the next section.

Manual Invoice Tracker Tools & The Hidden Flaws That Must Be Exposed

First of all, Excel and spreadsheets do not support real-time data updates when tracking invoices-especially when multiple people are working on or editing the same file simultaneously. This easily leads to data inconsistencies between departments, inaccurate reporting, or more seriously, late payments to suppliers.

Secondly, these manual tools completely lack the ability to send automatic alerts: every due invoice must be manually checked line by line. This process is extremely time-consuming, error-prone, and stressful for accounting staff-particularly during peak periods like year-end when invoice volumes are high. According to IFOL, 40% of respondents said their company’s relationship with suppliers had become strained due to delayed payment processing-a worrying situation for a partnership that aims to be long-term.

Moreover, team collaboration features are virtually nonexistent in Excel or Google Sheets unless a strict management process is in place. It’s common for one person to forget to update the file, another to overwrite data, or accidentally edit the wrong cell. As a result, accounts payable data lacks consistency and can even spark internal disputes when it’s impossible to determine who made the most recent and accurate update.

Security is also a major risk: Excel files can easily be edited unintentionally, deleted by mistake, or leaked if not properly protected. In today’s remote work environment or when files are shared via email, the risk of leaking a company’s financial information is entirely real.

Filtering, categorizing, or searching invoices by date, customer, or status in Excel is also highly manual. Without complex macros or formulas, accountants must repeat the same actions over and over-leading to exhaustion and mistakes. This inefficiency can spread across the entire invoice tracker system of the accounts payable department.

Most importantly: these tools were originally designed for static data with minimal changes. They might be suitable when the invoice volume is small and the company has few suppliers. But when invoices rise to hundreds or thousands per month, Excel or Google Sheets simply don’t have the “muscle” to handle the operational load.

How to keep track of invoices and payments?

To improve efficiency in using invoice tracker tools and managing accounts payable, businesses today need not only clear processes but also the adoption of advanced technologies. One of the key steps is the adoption of electronic invoices, which helps reduce paperwork, accelerate processing speed, and simplify storage, while also enhancing transparency in invoice management.

Technologies like OCR (Optical Character Recognition) and IDP (Intelligent Document Processing) are also suitable options as they are increasingly popular in automatically extracting data from paper or PDF invoices. This helps save time on manual data entry and reduces errors. As a result, accountants can track invoices more accurately while continuously updating the status of accounts payable, avoiding delays or omissions.

In addition, implementing automated bookkeeping helps automatically reconcile, record payments, and send alerts when invoices are due. This not only reduces workload pressure on the accounting team but also ensures effective accounts payable management, enabling businesses to maintain stable cash flow and improve relationships with suppliers.

In summary, combining traditional invoice tracking processes with modern technologies like IDP, OCR, e-invoicing or accounting automation is the key for businesses to manage invoice tracking and accounts payable effectively, save time, and avoid risks during peak seasons.

Practical Interface Practices For An Effective Invoice Tracking System

1. Easy Integration With Existing Systems (Erp, Accounting Software, Etc.)

2. Intuitive, User-Friendly Interface Even For Non-Tech Staff

Of course, not everyone in the accounting or purchasing department is tech-savvy. Therefore, the software interface needs to be optimized to be easy to understand, simple to operate, and minimize redundant steps. A good invoice tracker must ensure that after just a few uses, employees can easily master basic features such as data entry, invoice filtering, accounts payable tracking, checking payment deadlines, and exporting reports. A user-friendly interface is a crucial factor in accelerating practical implementation, especially during peak seasons where quick and effective deployment is essential.

3. Real-Time Invoice Status Updates

The ability to update invoice status in real time is a key factor in maintaining transparency and accuracy in the accounts payable management process. When tracking invoices, knowing the exact status of each invoice:

- Newly created

- Sent

- Due

- Overdue

- Paid

will help accountants take timely actions. Moreover, real-time data allows management to easily monitor the entire cash flow, detect invoices at risk of late payment early, and avoid passive situations with suppliers.

4. Automated Payment Reminders (Email/Sms Payment Alerts)

5. Quick Filtering/ Sorting/ Statistics By Customer, Due Date, Amount

6. High Security, Clear User Permissions

Managing invoice data and internal accounts payable information requires a high level of security to avoid financial information leakage, data errors, or unauthorized access. For automated accounts payable software, AFusion provides a clear permission mechanism for each role: data entry staff, reviewers, approvers, and report viewers. Moreover, at AFusion, every change related to invoices is recorded with a clear edit log. This helps reduce internal risks and enhances transparency in financial management and business cash flow health.

7. Comprehensive Reporting And Intelligent Alerts

8. Easy Invoice Storage & Retrieval For Reconciliation And Auditing

Each invoice is an important document related to accounts payable. Unsystematic storage or difficult retrieval will cost businesses a lot of time when reconciling with suppliers or during internal audits. A good invoice tracker must allow cloud storage, keyword or filter-based search, and tagging and annotation features that are easy to understand. This helps businesses build an intelligent storage system, ready for any future audit.

Conclusion: One-Time Investment – Long-Term Savings

Peak season is not only a golden opportunity for businesses to accelerate revenue growth, but also a stress test for the entire operational system-especially the accounting department. Without the right tools to manage accounts payable and monitor invoices, it’s your team-those staying late every night-that will bear the brunt of the consequences.

From being overwhelmed by manual tasks and prone to data errors, to risking financial loss and damaging relationships with suppliers, the root cause is often an outdated, inefficient system. It’s time for businesses to take bold steps toward adopting a specialized invoice tracker, integrated with technologies such as OCR, IDP, e-invoicing, and automated bookkeeping.

You can reach out to AFusion for tailored support and solutions that fit your company’s needs. Investing in an effective invoice tracker is not just a fix for peak-season accounts payable-it’s the foundation for building a robust, transparent financial system ready for sustainable growth.

Previous Post

Previous Post Next Post

Next Post