Resources > Blog > 37> Invoice Automation: The Future Starts Today

Invoice Automation:

The Future Starts Today

Take a look at your company’s invoice and payment process. Has it been a bit… slow or getting stuck somewhere lately? According to CFO, 53% of financial and accounting leaders say they’ve wasted time on repetitive tasks simply due to a lack of automation. As a result, it severely harms the productivity of the business.

Does this scenario sound familiar to your company? If it does, don’t worry too much. In this article, we’ll provide insights on the benefits and misconceptions about invoice automation. This way, you’ll better understand how to make a breakthrough change. Luckily, you don’t have to wait for the distant future to fix this; you can start right now with small changes in your decisions.

Invoice Automation – What Does Touchless Operation Look Like?

Invoice automation is the method of using technology to automate and streamline the entire invoice processing workflow. Simply put, this is a way for accountants to delegate repetitive tasks to machines. Surprisingly, almost the entire invoice process from A to Z doesn’t require manual data entry. It includes streamlining processes from receipt, validation, approval to invoice payment. Any business that processes purchase invoices needs this type of invoice processing workflow. Some industries already effectively apply automation, including retail, food distribution, restaurants, beverage chains, and logistics.

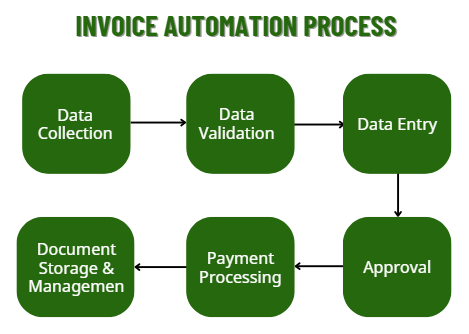

The invoice automation process works as follows: an invoice is sent to the email or system, it is automatically processed and then entered into the internal accounting system without any manual intervention. Here are the steps of the manual process:

Although automated invoice processing is not too complicated, many people often confuse it with electronic invoicing (e-invoice). In fact, an e-invoice is simply a digital version of a paper invoice. It’s created and stored in the cloud rather than on paper, as your business may still be doing. While e-invoices are convenient, they still require accountants to manually handle them. On the other hand, invoice automation is a more advanced step where everything is done automatically from reading information, classifying invoices to processing payments, without heavy intervention from staff. So, don’t confuse them. Remember that an e-invoice is just one step automated invoice processing. To make it easy to remember, an e-invoice is like an “electric bike,” while invoice automation is like a “self-driving car!”

Benefits That Pay Back with Time and Cash

Faster Processing, No More Month-End Invoice Bottlenecks

For accountants, the most challenging time usually occurs at the end of the month or quarter. That’s when a large volume of invoices comes in at once, but the manual processing workflow can’t keep up. A small delay in one step can create a bottleneck that stops the entire system. Invoices pile up, and processing becomes rushed, leading the accounting team to always be in a “sprint mode.”Conversely, when a company adopts invoice automation, each step from receiving, checking, to storing is done three to five times faster than manual processing. Not only does it save time, but automation also significantly reduces errors and ensures smooth, on-time payment processing.And the best part? The image of accountants manually filtering through Excel files while sweating over deadlines will gradually disappear. Instead, there will be a streamlined, efficient process, allowing the business to maintain consistent productivity without relying on those end-of-month “sprints” anymore.

Reducing Errors, Increasing Accuracy and Transparency

No Lost or Missing Invoices

Fraud is Less Likely to Slip Through

Stories about “tweaking numbers,” adding unauthorized invoices, or approving information carelessly will no longer be easy to get away with. The invoice automation system logs every action and has clear permission settings. If an accountant wants to make changes to anything, it must be logged. This significantly reduces internal fraud, and you can rest assured that every penny spent has a clear reason no one can bypass the system.

Efficient Operation, Easily Scalable When Needed

Barriers and Misconceptions When Adopting Invoice Automation

-

First: Fear of High Initial Costs

Many businesses, especially small and medium enterprises, think that invoice automation is an expensive investment, only suitable for large corporations with strong budgets. However, the technology business model has changed significantly. Automation platforms now offer flexible service packages based on a “pay-as-you-go” model. This allows businesses to only pay for the actual number of invoices processed each month. Additionally, many solutions offer phased implementation, so businesses can control initial costs and assess effectiveness before scaling. So, the fear of “high costs” is no longer a valid reason to delay your transformation.

Second: Fear of Difficult System Integration

In addition to concerns about cost, there’s also the worry that adopting automation will disrupt existing systems, causing the accounting team to spend extra time adapting or having to change all the software in use. In reality, today’s invoice automation solutions are designed to integrate with accounting or ERP software such as SAP, Oracle, or even custom systems. This means businesses can implement automation step by step without disrupting current operations or overwhelming staff with sudden changes.

-

Third: Fear of Losing Control and Data Leakage

When the system handles everything, CFOs may be concerned about losing visibility over invoice statuses and the increased risk of data leakage. However, the truth is quite the opposite. Automation platforms offer tighter control through audit logs. You can see who did what, at what time, and at what stage. Each invoice can be tracked and verified accurately. At the same time, data is protected with clear user permissions, minimizing the risks of manual errors, such as printing the wrong document, sending it to the wrong person, or losing information.

-

Fourth: Fear of the Time and Complexity of Learning New Tools

Automation Is Not in the Future – It's in the Present

but also in processing speed and business transparency. Companies that allocate budgets correctly, maintain good control, and pay on time will easily gain the trust of their partners, while also helping their own business manage cash flow more stably.

Previous Post

Previous Post Next Post

Next Post