Resources > Blog > 10> iAutobot – How RPA In Accounts Payable Superior?

iAutobot - How RPA In Accounts Payable Superior?

According to Strategic Market Research, RPA technology will play an important role in automating up to 40% of transactional accounting work by 2025. The accounts payable process, which is considered one of the core activities of a business, will be significantly improved thanks to RPA. So how can RPA help businesses optimize the accounts payable process? This article will answer that question.

What is RPA?

Robotic process automation (RPA) is a technology that enables a virtual robot — or “bot” — to simulate human interaction with computer applications to perform processes.

The benefits of RPA in Account Payable

Flexible and Adaptable:

- Let’s say there is a major change in industry regulations. With RPA, businesses can quickly update their systems and comply with the new regulations without having to change their entire workflow.

- With RPA, businesses can easily adapt to changes in the market and customer needs, creating a sustainable competitive advantage.

Reduce risk and increase accuracy:

- Errors in data entry and invoice calculation are the nightmare of many businesses. RPA in accounts payable will help completely eliminate the human factor, ensuring absolute accuracy for all data, thereby minimizing risks and increasing the reliability of reports.

- Especially in the financial sector, where small errors can cause big consequences, RPA in accounts payable is a safe insurance solution.

Efficient Process Automation:

- Invoice Generation: RPA in accounts payable fully automates the invoice generation process, from data retrieval from the ERP system to final invoice issuance, saving time and reducing errors.

- Invoice Approval: The invoice approval process becomes faster and more transparent with RPA. Approval requests are automatically sent to the authorized person, reducing processing time and increasing work efficiency.

- Account Reconciliation: RPA performs account reconciliation quickly and accurately, helping to detect discrepancies immediately and minimizing the risk of incorrect receivables/payables.

Optimize costs and increase productivity:

- Reduce labor costs: RPA reduces labor-intensive tasks by 80%. RPA reduces the need to hire people for repetitive tasks, thereby saving on labor costs.

- Increase productivity: Thanks to RPA, employees can focus on higher value-added tasks, such as data analysis and strategic decision-making. Businesses typically receive an average return of $6.74 for every $1 invested in RPA technology.

Improve customer experience:

- Customers are happier when they receive accurate invoices and have their orders processed quickly. RPA helps improve service quality and increase customer loyalty.

iAutobot - RPA in Accounts Payable and How We Talk About Bots

What is iAutobot?

iAutobot – AFusion’s Digital Worker. A virtual execution engine that simulates human mouse clicks or keystrokes through the user interface of applications. Simply put, iAutobot can perform repetitive tasks on a computer accurately and quickly, just like a digital worker who is always available 24/7.

iAutobot realizes automation opportunities. iAutobot, as an RPA robot, opens up countless automation opportunities for businesses. With a friendly and easy-to-use interface, iAutobot makes it easy for even non-techies to create and manage automation processes.

What actually iAutobot can do?

iAutobot – RPA Robot acts as a virtual user, accurately simulating computer operations such as mouse clicks and keystrokes. At the same time, the Bot is also capable of working with detailed process documents, ensuring that every step is accurate and compliant.

With RPA, daily tasks become simpler than ever. From basic tasks such as data entry, report creation to more complex tasks such as reading PDF documents, sending emails, RPA can perform them all automatically and efficiently.

Intelligent process automation, combining RPA and AI, brings a new breakthrough. Thanks to the ability to learn and adapt, RPA bots are becoming more and more intelligent, able to handle complex transactions and make data-driven decisions.

RPA is not limited to internal applications. RPA bots can easily log in and perform tasks on accounting applications. Additionally, RPA in accounts payable can operate and even retrieve data from websites, expanding the scope of enterprise automation.

The role of iAutobot in business

1. F&B

Optimizing Invoice Processing

Applying RPA to invoice processing in the F&B industry brings outstanding efficiency. By automating repetitive tasks such as data entry, data reconciliation and payment voucher creation, RPA significantly reduces processing time, thereby increasing productivity and minimizing errors.

Reducing errors and improving supplier relationships

RPA plays an important role in ensuring data accuracy and minimizing errors in invoice processing, helping to build a trusting relationship with suppliers. On-time and accurate payments thanks to RPA contribute to enhancing the reputation of the business and creating conditions for long-term cooperation.

Ensuring compliance with food safety regulations

In the F&B industry, compliance with food safety regulations is extremely important. RPA helps businesses closely manage processes related to raw material origin, quality control and record keeping. Thanks to that, businesses not only ensure product quality but also meet legal requirements.

2. Retail

Automate Repetitive Tasks

RPA in accounts payable offers retailers the ultimate solution by automating daily repetitive tasks such as purchase order (PO) management, inventory control, and returns processing. This frees employees from tedious, manual tasks, allowing them to focus on higher-value tasks.

Improve operational efficiency and reduce costs

The adoption of RPA helps retail businesses significantly improve operational efficiency. By eliminating common errors in manual data entry, RPA ensures the accuracy of information, thereby minimizing errors in business processes and saving significant costs.

Freeing employees for higher-value activities

RPA is not only a support tool but also a powerful companion for retail employees. By automating repetitive tasks, RPA in accounts payable frees employees up to focus on value-added activities such as data analysis, building customer relationships, and developing new business strategies.

3. Professional services

Automate large volumes of invoicing tasks

RPA is the optimal solution for automating large volumes of invoicing-related tasks in professional services. By entrusting robots with repetitive tasks such as creating invoices, entering data, and reconciling figures, RPA saves significant time and reduces errors.

Improve cash flow and reduce administrative workload

Automating invoice processing processes with RPA significantly improves a business’s cash flow. By minimizing processing time and ensuring timely payments, RPA contributes to increased debt collection. At the same time, RPA also significantly reduces the administrative workload of accounting staff.

Freeing up accounting staff for customer service and strategic initiatives

RPA frees accounting staff from manual, tedious tasks, allowing them to focus on higher-value activities such as providing quality customer service, analyzing data, and participating in strategic business projects.

Standardize invoice formats and ensure accurate data collection

RPA plays a vital role in ensuring data consistency and accuracy. By automating the process of creating and processing invoices, RPA helps standardize invoice formats, minimize errors, and ensure that all data is collected accurately and completely.

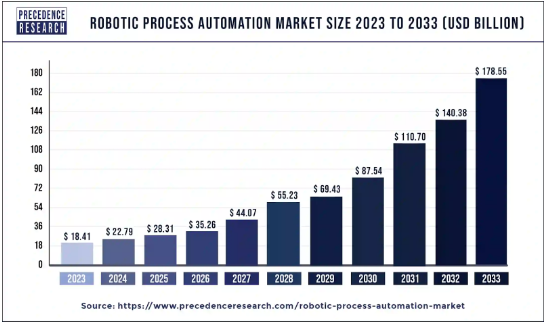

According to Precedence Research, the global Robotic Process Automation Market size is expected to reach US$ 178.55 billion by 2033, projected to grow at a remarkable CAGR of 25.7% during the forecast period from 2024 to 2033. The increasing adoption of automation across various industries to streamline business processes and improve operational efficiency is the trend and the ultimate solution for businesses.

Previous Post

Previous Post Next Post

Next Post