Resources > Blog > 33> How to audit accounts payable

How To Audit Accounts Payable

What is an accounts payable audit?

In many audits, the accounts payable department is often scrutinized the most. While it may cause some anxiety, internal audits bring numerous benefits to businesses. They help detect errors, bottlenecks, and potential issues early before they cause damage, ultimately saving time and costs for businesses.

Accounts payable audits are not just a tool for regulatory compliance; they also help businesses maximize automation, improve efficiency, and optimize financial processes. More importantly, audits are not about finding mistakes to blame employees but about enhancing work efficiency. When properly understood, they serve as a proactive measure to ensure financial health, contributing to long-term stability and growth.

Why do businesses need an accounts payable audit?

Every business needs to check its payments by preparing financial reports covering all cash expenditures, purchases, and services throughout a fiscal year. Auditors then use specialized tools to compare recorded transactions with financial documents to ensure they match. If any discrepancies arise, auditors investigate further to determine their validity.

There are millions of reasons why businesses should care about accounts payable audits, whether internal or external. This is a crucial tool that helps detect errors and prevent invoice fraud . Here are the key reasons why accounts payable audits are essential:

- Building trust: A well structured audit process helps establish trust with suppliers, partners, and stakeholders by ensuring financial statements are transparent and accurate. This creates a solid foundation for long-term partnerships.

- Enhancing financial stability: Audits help prevent unauthorized transactions, duplicate invoice payments, and data entry errors. Detecting financial discrepancies or fraudulent activities early can protect a company’s reputation and prevent unnecessary losses.

- Providing accurate financial insights: An accounts payable audit ensures that financial statements accurately reflect the company’s financial position, helping CFOs identify areas that need improvement. This allows businesses to focus on the right issues, avoiding wasted time and resources.

- Simplifying tax reporting: Audits help businesses streamline tax filing by ensuring all expenses are properly classified and reported. This reduces the risk of penalties, late payment interest, or tax audits.

- Ensuring compliance: Audits confirm that businesses adhere to internal policies and legal regulations. This minimizes risks related to tax law violations and other legal standards, preventing unwanted legal consequences.

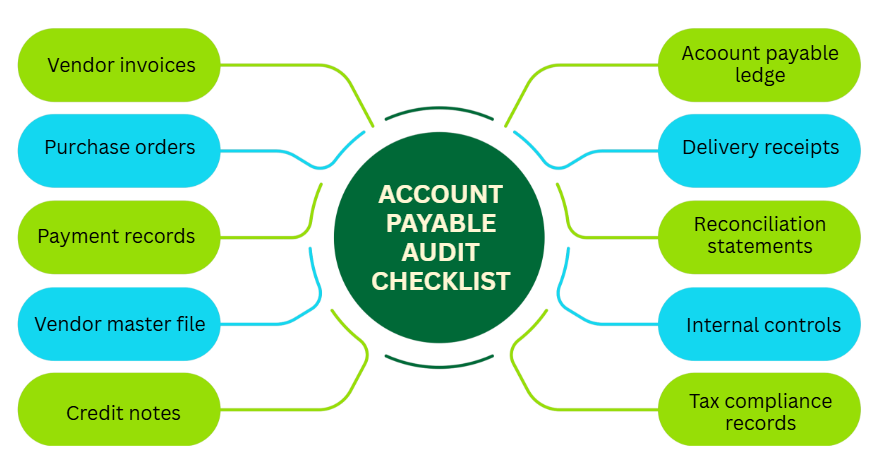

What does an AP audit checklist include?

Starting an accounts payable audit can be a complex and time-consuming task. The process involves four key steps: Planning – Reviewing – Reporting – Follow-up. Alongside these steps, an audit checklist helps manage the entire process efficiently. This checklist includes 10 crucial documents to ensure accuracy and transparency in the audit process.

How to audit accounts payable?

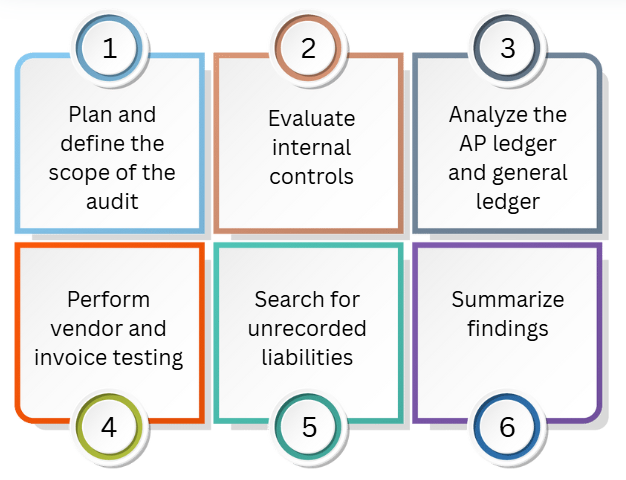

Step-by-step guide to auditing accounts payable:

1. Plan and define audit scope:

To conduct a smooth accounts payable audit, auditors must first create a clear plan and define the audit scope. They need to determine the audit timeline, usually at the end of a quarter or fiscal year, and prepare for on-site auditing. The main goal is to ensure all transactions are transparent, valid, and compliant with regulations while financial information is accurately reported. Additionally, the audit team must have access to relevant documents and systems, such as accounting software, procurement systems, and approval records. They may also interview employees handling accounts payable to clarify information and review physical storage for document verification.

2. Evaluate internal controls:

Internal controls are crucial in preventing errors and fraud invoice in accounts payable processes. Auditors first examine task assignments to ensure no one has complete control over the entire process from invoice approval to payment processing and bank reconciliation. If a single person handles everything, the risk of fraud increases.

The audit also checks if the approval process follows company policies to prevent incorrect or unauthorized payments. A critical step is performing a three-way match between invoices, purchase orders, and receiving reports to ensure accuracy before making payments. According to Gartner, 59% of audit executives focus on providing deeper, actionable insights by identifying root causes of problems and control weaknesses. Supplier management is also reviewed to detect fake or duplicate suppliers. If internal control gaps are identified, businesses should promptly implement corrective measures, especially for suspicious transactions like duplicate payments or unclear supplier transactions.

3. Analyze the AP ledger and general ledger:

Analyzing the accounts payable (AP) ledger and the general ledger is a crucial step in ensuring the accuracy and completeness of financial data. Auditors need to compare the AP balance with the general ledger to identify any discrepancies while also reviewing end-of-month reconciliations to confirm that all outstanding payables have been properly recorded.

Additionally, special attention should be given to unusual entries, such as large or frequent adjustments, as these could indicate errors or fraud. Detecting and addressing these anomalies in a timely manner helps businesses maintain transparency and accuracy in financial management. In this step, if a business processes data entirely manually, data entry errors are more likely to occur, reducing analysis efficiency and affecting the accuracy of the process.

4. Test suppliers and invoices:

In this step, auditors randomly sample suppliers and invoices to verify transparency and accuracy. First, they check whether supplier information is complete, including name, address, and tax ID. Then, they compare invoices with purchase orders, contracts, and delivery reports to ensure alignment. Next, they review the amount, payment date, and agreed terms for accuracy. Finally, they check for duplicate payments by cross-referencing invoice numbers and payment amounts. If discrepancies are found, they send confirmation letters to suppliers to verify outstanding balances.

At this stage, businesses can reduce the audit workload by automating data with iAutobot. This technology allows auditors to track and reconcile information more conveniently and accurately, thanks to automatically aggregated and analyzed data. As a result, complex and time-consuming reconciliation processes become easier and more efficient.

5. Identify unrecorded liabilities:

To ensure no liabilities are missed, businesses must review their AP ledger while checking for unusual transactions before or after the audit period. Additionally, they should track received goods without invoices and compare supplier reports to identify any overlooked payments. Verifying unrecorded liabilities requires significant time to ensure accuracy and data transparency. If all data is processed manually, this task can take weeks, depending on the complexity of the invoices that need verification.

6. Summarize findings:

Finally, auditors compile key findings into an audit report. This report should summarize the procedures performed, key observations, identified errors, risks, and control weaknesses. It should also include recommendations to address existing issues, helping businesses improve their accounts payable management system and minimize future risks.

How to make AP audits easier?

Although we live in the digital age, many small and medium-sized enterprises (SMEs) still perform audits manually, which often involves the tedious task of handling and searching for paper invoices. Investing in AP automation software can make audits much easier, allowing businesses to retrieve organized records with just a few clicks through cloud storage.

How AP automation improves accounts payable audits: It mitigates risks associated with manual processes. An audit should not be feared if proper record-keeping is in place. It is an independent and systematic review of a company’s AP records to ensure accuracy. Even if there are negative results, this should be seen as a learning experience for maintaining more accurate record-keeping and strengthening fraud detection to ensure the sustainable growth of the business. AP audits focus on risk assessment and should be valued as an essential process. Contact AFusion today to discover the solutions we have implemented for our partners.

Previous Post

Previous Post Next Post

Next Post