Resources > Blog > 47> What Is An Accounts Payable Aging Report?

What is an Accounts Payable Aging Report?

What is an AP Aging Report?

An accounts payable aging report is an accounting document that compiles unpaid invoices, organized by supplier and specific due dates. This report offers a clear overview of current debts, including invoice issuance dates and payment terms. Its main goal is to assist finance teams in prioritizing payments to key suppliers. This is particularly valuable when a business faces financial pressure.

The report also identifies overdue amounts, minimizing the risk of losses. With technological advancements, generating an accounts payable aging report is now faster and more accurate. Since supplier relationships significantly impact business operations, this tool becomes indispensable. Using it effectively helps companies avoid penalties and boost their reputation.

What Information Does an Accounts Payable Aging Report Include?

An AP aging report provides essential data for better financial management. It starts with invoice details and supplier information, such as the invoice creation date and account codes. Due dates are categorized into 30-day intervals for easy tracking.

The total debt amount is calculated precisely in the report. It also highlights invoices eligible for early payment discounts, aiding cost savings. Understanding these elements empowers finance teams to make informed decisions.

Additionally, the report flags potential risks, like overdue invoices. This ensures businesses maintain control over financial obligations, safeguard cash flow, and preserve supplier relationships.

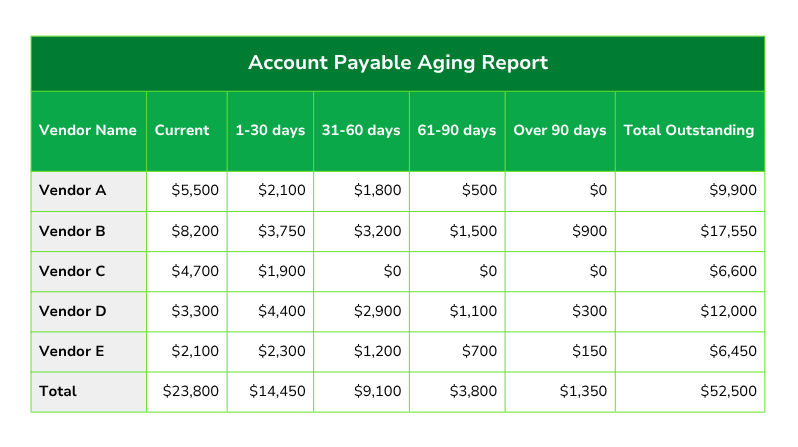

Examples of an Accounts Payable Aging Report

Consider a practical example to grasp the AP aging report. A typical report divides unpaid invoices into categories: Current, 1-30 days, 31-60 days, 61-90 days, and over 90 days.

For instance, a company might notice a 15 million VND invoice from Supplier X in the 1-30 day range, while an 8 million VND invoice from Supplier Y exceeds 90 days. Regularly reviewing the report helps prioritize payments effectively. This prevents late fees and sustains strong supplier partnerships.

Beyond management, the report aids in cash flow forecasting. Analyzing its data supports strategic payment planning, fostering long-term financial growth.

Benefits of an AP Aging Report by Due Date

The AP aging report delivers significant value to businesses. Primarily, it enhances supplier relationships. Timely payments create a stable business environment. The report highlights pending amounts and overdue statuses, enabling efficient payment prioritization.

Enhancing DPO Strategy

The report supports a smart DPO (Days Payable Outstanding) strategy. With automation tools, businesses can schedule payments to optimize DPO while maintaining good supplier ties.

Swift Error Resolution

Boosting Cash Flow

The report aids in crafting effective cash flow plans, allowing flexible financial adjustments. McKinsey emphasizes that stable cash flow is vital, and this tool accurately predicts future financial needs. It helps avoid short-term risks and maximizes available resources for sustainable growth.

Safeguarding Against Fraud

Neglecting close monitoring of accounts payable exposes businesses to financial risks and fraud. A report from the European Central Bank shows that in the first half of 2023, transfer fraud losses reached 967 million EUR, with 86% attributed to user responsibility. Lingering debts or unchecked payments create vulnerabilities for fraud.

The accounts payable aging report enables early detection of irregularities, preventing duplicate or erroneous payments. This tool is key to controlling cash flow, minimizing fraud risks, and ensuring financial transparency during operations.

How to Create an Accounts Payable Aging Report

To build an accounts payable aging report, start by gathering invoice data, including invoice numbers, supplier names, and payment terms. Solutions like AFusion streamline this process efficiently.

Next, divide due dates into 30-day brackets (0-30, 31-60, 61-90) for prioritization. Then, sort invoices by age and calculate the total debt if done manually. Finally, review thoroughly to eliminate errors like duplicate entries.

Using AP automation software ensures accurate, cost-effective report creation. Regular updates help businesses manage payments proactively, avoid penalties, and optimize cash flow.

How to Read and Analyze an Accounts Payable Report

To interpret an accounts payable aging report, examine current balances and overdue ranges (1-30, 31-60, 61-90, over 90 days). This helps determine when cash is needed for payments.

Then, check individual supplier balances to spot anomalies or negative figures. If issues arise, contact suppliers for resolution. Consistent analysis of the report enhances debt management capabilities.

Tools to Support AP Aging Reports

Businesses should leverage accounting software or ERP systems to optimize AP aging reports. These tools automate monthly reports, reducing manual errors. AFusion stands out as a reliable option, integrating data from various sources.

Avoid manual Excel use, as it often leads to calculation mistakes, especially for small businesses. Investing in specialized tools like AFusion delivers superior efficiency in managing these reports.

Trends in Automating Accounts Payable Aging Reports

Automation is a growing trend, driven by AI and IDP technologies. Specifically for accounts payable, it digitizes invoices and generates aging reports with high accuracy.

AFusion applies AI to simplify accounts payable aging reports, making financial management seamless. Automation saves time, allowing finance teams to focus on strategic goals, shaping the future of debt management.

The AP aging report is a critical tool for effective financial management. It strengthens supplier relationships, optimizes cash flow, and prevents fraud. With AFusion, businesses can create these reports quickly, supporting sustainable growth. Contact us!

Previous Post

Previous Post Next Post

Next Post