Resources > Blog > 24> The Importance Of 2 Way And 3 Way Matching: Time To End Manual Processes

The Importance Of 2 Way And 3 Way Matching: Time To End Manual Processes

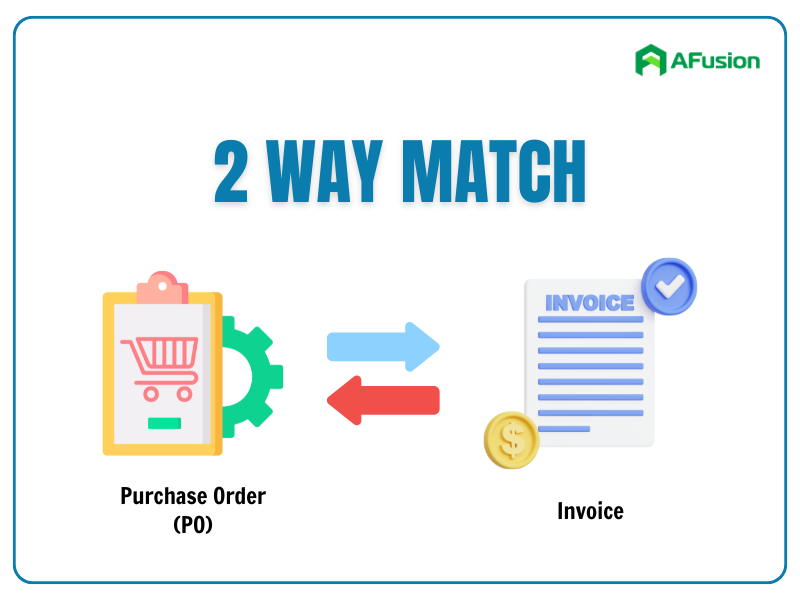

What is Two-Way Matching in Accounts Payable (AP)?

When a business places an order, the terms are documented in a purchase order (PO). The PO includes key details such as items, quantities, contract value, and payment terms. Subsequently, the customer receives an invoice from the supplier for payment of the goods or services specified in the PO. The AP team then compares the quantities and values on the PO with the invoice. This process is called two-way matching.

This process involves comparing two key documents: the Purchase Order (PO) and the Invoice, to verify that the information regarding item quantities, prices, and payment terms on the invoice matches the details in the PO. The goal of two-way matching is to ensure that the company only pays for goods or services delivered as per the purchase order.

Example of two-way matching:

- Purchase Order: Company ABC orders 100 products from supplier XYZ. The PO specifies that each product costs $50, totaling $5,000.

- Supplier Invoice: XYZ sends an invoice requesting payment of $5,000 for 100 products.

- Two-Way Matching: The AP department compares the two critical documents—the PO and the Invoice. Both documents must match in terms of quantity and value.

- Payment: If the PO and Invoice match, ABC pays XYZ without needing to reconcile a goods receipt.

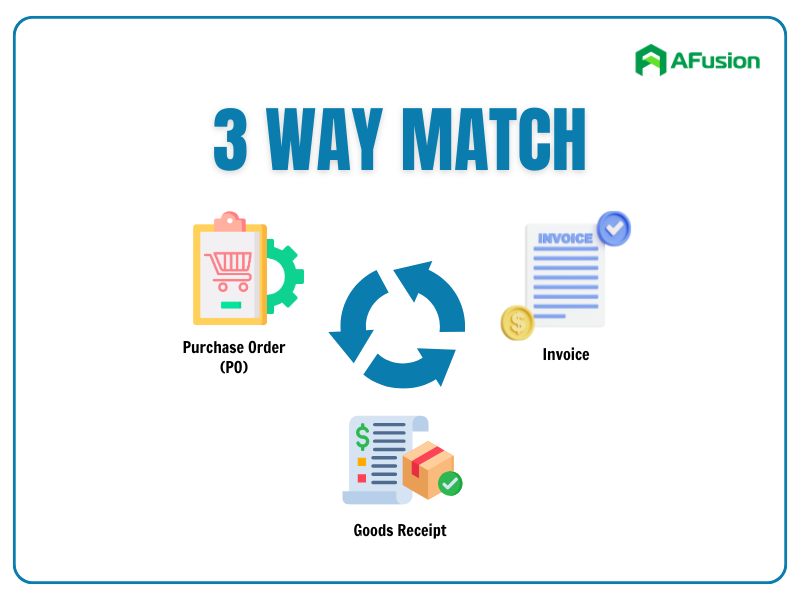

What is Three-Way Matching in Accounts Payable (AP)?

Unlike two-way matching, which compares only the PO with the invoice, three-way matching includes an additional document: the goods receipt. Specifically, in three-way matching, the AP team verifies not only the PO and Invoice but also the goods receipt to confirm that the delivered goods match the order.

This method helps identify and prevent discrepancies or fraud, such as paying for undelivered items or incorrect quantities or values. Between 2 way and 3 way matching reconciliation, 3-way reconciliation is preferred because of its higher accuracy and reduced risk of incorrect payment. However, both 2 way and 3 way matching methods have their merits depending on company size, systems, and business relationships.

Example of three-way matching:

- Purchase Order: Company ABC orders 100 products from supplier XYZ. The PO specifies that each product costs $50, totaling $5,000.

- Supplier Invoice: XYZ sends an invoice requesting payment of $5,000 for 100 products.

- Goods Receipt: ABC receives the goods from XYZ and records a receipt confirming all 100 products were delivered.

- Three-Way Matching: The AP team compares the PO, Invoice, and Goods Receipt to ensure accuracy.

- Payment: Only after all three documents align in quantity and value does ABC proceed with payment to XYZ.

Why is Manual Matching Harmful to Businesses?

2 way and 3 way matching document reconciliation in the AP process is important and impacts a number of other business workflows. Yet, many businesses still rely on manual processes for this task. According to CPA Practice Advisor, many organizations have yet to prioritize AP automation. Only 10% of businesses have fully automated their AP process, and just 38% of SMBs have partially automated it.

Manual matching incurs significant costs for businesses. On average, processing each invoice manually costs $11, sometimes as high as $25. Additionally, payment methods like writing checks or handling postal mail add another $6 per transaction. For companies handling hundreds of thousands of invoices annually, these costs escalate rapidly, alongside risks such as late payment penalties or missed early payment discounts.

Moreover, manual data entry and reconciliation are prone to errors and fraud. Common issues such as data input mistakes or duplicate payments not only result in financial losses but also increase workload pressures. Limited visibility into invoice status and cash flow further hampers business control, reducing flexibility in managing expenses and finances.

Finally, manual processes harm supplier relationships. Late payments or errors can erode trust, disrupt supply chains, and limit future collaboration opportunities.

Automating AP as a Key Business Advantage

While the adoption rate of AP automation by businesses remains low and 2 way and 3 way matching reconciliation is still common, a fundamental shift is taking place today.. Today, as customer-focused and front-office technologies become widespread, CFOs are shifting their focus to back-office automation, particularly AP, to boost efficiency and cut costs.

Accountants, CFOs, and other business leaders are recognizing the value that AP automation brings to companies of all sizes. Automation has helped them reduce AP-related costs by over 75% and achieve ROI within 3–4 months. Businesses can also generate revenue by leveraging virtual cards offering cashback.

Automating the AP process marks a significant leap in financial management, enabling businesses to process invoices and payments quickly and accurately. Invoices are sent directly to a management system where buyers can monitor and control all data. This process not only increases operational efficiency by up to 73% but also reduces costs by up to 81%.

The optimized process begins with the buyer issuing a clear purchase order, documenting the total payment due. This order is electronically sent to approved suppliers, ensuring transparency and control from the outset. When suppliers send electronic invoices, the system automatically reconciles the information. 2 way and 3 way matching is performed seamlessly, eliminating manual errors.

Once an invoice is approved, payments are made via various methods, such as checks, wire transfers, or international payments. The entire process is streamlined, removing the need for manual paperwork. Additionally, the system provides comprehensive tracking, allowing businesses to monitor every payment detail, reduce surprises, and promptly identify potential discrepancies.

The benefits of automated 2 way and 3 way matching reconciliation go beyond saving time and money. Automation enhances supplier relationships through on-time payments and strengthens cash flow management. It also enables informed financial decision-making based on accurate, up-to-date data. With these advantages, AP automation is not just a trend but a strategic necessity, driving businesses forward in today’s competitive landscape.

Previous Post

Previous Post Next Post

Next Post