Resources > Blog > 36> Outsourcing for Order to Cash

Outsourcing For Order To Cash

What is the Order to Cash (O2C) Process?

The Order to Cash (O2C) process, also known as OTC, encompasses the entire cycle of activities involved in handling a business’s orders – from the moment a customer places an order to the point where the company receives payment and finalizes the settlement. It’s a comprehensive process that integrates various stages, including marketing, sales, and financial management, playing a pivotal role in ensuring a company’s success and fostering long-term customer relationships.

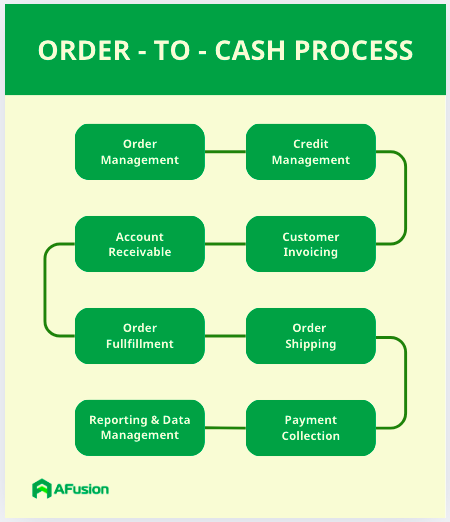

At its core, the O2C process consists of eight fundamental steps:

- Step 1: Order Management – Tracking orders from receipt to completion, ensuring transparency and minimizing errors.

- Step 2: Credit Management – Assessing a customer’s creditworthiness and setting appropriate credit limits to mitigate the risk of bad debt.

- Step 3: Order Fulfillment – Processing orders, picking products, packing, and preparing for delivery with accuracy and efficiency.

- Step 4: Shipping – Coordinating with logistics providers to ensure timely delivery, reducing the chances of delays or lost shipments.

- Step 5: Customer Invoicing – Generating detailed, accurate invoices and sending them to customers to initiate the payment process.

- Step 6: Accounts Receivable – Monitoring unpaid invoices, sending reminders to customers, and automating debt collection processes.

- Step 7: Payment Collection – Receiving payments through various methods and ensuring accurate reconciliation to avoid discrepancies.

- Step 8: Reporting & Data Management – Using ERP software to track, analyze, and optimize the O2C process for improved efficiency.

Many assume that the Order to Cash cycle ends once the customer pays the invoice, but in reality, it extends beyond that. Post-payment steps, such as data recording and performance analysis, are critical. Collecting and evaluating data throughout the O2C process enables businesses to identify opportunities for improvement, streamline operations, and enhance overall efficiency. For instance, analyzing payment delays can reveal bottlenecks in invoicing, while tracking delivery times can highlight issues in logistics. Thus, O2C is not just an administrative workflow, it’s a strategic tool for driving growth, improving cash flow, and boosting customer satisfaction.

Challenges in the Order to Cash Process

While the Order to Cash process may seem straightforward, it involves a complex, interdependent series of steps. A single hiccup in any stage can disrupt the entire cycle, affecting everything from cash flow to customer relationships. Effective coordination between departments – such as sales, finance, and customer support – is essential but often challenging. Here are some common issues businesses face:

- Order Errors: Mistakes in orders, such as incorrect quantities or items, require adjustments or reprocessing, wasting time and resources.

- Manual Invoicing: Traditional, manual invoicing methods are time-consuming, labor-intensive, and prone to errors, slowing down the payment cycle.

- Customer Dissatisfaction: Any glitch in the process, from delayed deliveries to inaccurate invoices, can negatively impact the customer experience.

- Delayed Debt Collection: Slow payment cycles strain cash flow and disrupt other operations, such as payroll or procurement.

- Data Security Risks: Data breaches or leaks can erode customer trust and damage a company’s reputation.

These challenges don’t just affect internal efficiency, they also impact broader systems like customer relationship management (CRM). For example, manual invoicing delays payment processing, which in turn slows debt collection, creating a ripple effect across financial operations.

According to McKinsey, the O2C process is one of the most complex administrative workflows, accounting for 1-3% of a company’s revenue. With multiple functions involved – sales, finance, legal, and customer support – ensuring alignment across these teams is critical but difficult.

Poorly managed O2C processes lead to increased costs, inefficiencies, and profit leakage. Moreover, today’s customers expect a seamless, transparent ordering experience with real-time updates and swift dispute resolution – standards that traditional O2C systems struggle to meet. For instance, a customer might expect instant tracking updates similar to those provided by e-commerce giants like Amazon, but outdated systems may fail to deliver such visibility.

As businesses adapt to modern demands, such as B2B e-commerce or subscription-based sales models, the need for technology upgrades and process improvements becomes even more pressing. Outsourcing the O2C process emerges as a viable solution to address these challenges.

Outsourcing the Order to Cash Process

The Growing Trend of Order to Cash Outsourcing

Outsourcing the Order to Cash process (O2C outsourcing) involves delegating part or all of the O2C cycle to a third-party service provider. This strategy allows businesses to focus on their core competencies while leveraging the expertise and technology of a partner to manage the complexities of O2C.

According to Market Research, the global Finance and Accounting Outsourcing (FAO) market is estimated to reach $52.3 billion in 2024 and is projected to grow to $75.2 billion by 2030, with a CAGR of 6.2%. Within this market, multi-process FAO, which includes O2C outsourcing, is expected to grow at a CAGR of 7.1%, reaching $26.6 billion by 2030. FAO services go beyond basic tasks like bookkeeping or debt management, they also ensure regulatory compliance, financial reporting, and operational efficiency.

Several factors are driving the rise of O2C outsourcing:

- Complex Financial Regulations: Specialized providers help businesses navigate intricate compliance requirements more effectively.

- Global Expansion Needs: Companies expanding internationally require scalable, adaptable financial services across diverse markets.

- Digital Transformation: Integrating advanced technologies like automation, AI, and blockchain demands expertise that outsourcing partners can provide.

- Cost Reduction Pressures: In an uncertain economy, outsourcing offers a cost-effective way to streamline operations.

Additionally, evolving consumer behavior plays a role. As trust in third-party providers grows, businesses are increasingly comfortable outsourcing critical processes like O2C. For example, a mid-sized manufacturing firm might outsource its O2C to focus on product innovation, relying on a BPO provider to handle invoicing, debt collection, and reporting.

Benefits of Outsourcing O2C for Enhanced Performance

Outsourcing the O2C process provides CFOs and CEOs with a clearer, more strategic view of their operations, enabling better decision-making. Partnering with a Business Process Outsourcing (BPO) provider offers several tangible benefits:

First, cost savings and resource optimization. BPO providers typically operate in regions with lower labor costs, enabling businesses to significantly reduce operational expenses compared to maintaining an in-house team. The savings can be reinvested into strategic goals such as new product development or market expansion.

Second, access to cutting-edge technology and expertise. Business process outsourcing offers the opportunity to leverage advanced tools like automation, data analytics, and AI without requiring large investments. This leads to faster order processing, fewer errors, and an improved customer experience, thanks to the deep expertise of service providers.

Third, focus on core competencies. By outsourcing administrative tasks like Order to Cash, businesses can allocate resources to high-value activities such as product innovation, customer relationship management, or long-term strategic planning. This is particularly beneficial for small businesses or those with limited resources.

Fourth, flexible scalability. BPO allows companies to scale their Order to Cash processes according to actual demand. During peak seasons, operations can expand without the need to hire additional staff; conversely, when demand declines, businesses can easily downsize without facing workforce reduction challenges.

Fifth, risk mitigation. BPO providers often have comprehensive risk management systems in place, covering everything from data security to regulatory compliance. Partnering with a reliable provider helps businesses minimize O2C-related risks, ensure business continuity, and safeguard sensitive information.

By outsourcing O2C, businesses not only improve efficiency but also better meet the expectations of modern customers, delivering faster, more reliable services in a digital-first world.

How AFusion Can Optimize Order to Cash Process

AFusion offers a comprehensive solution to automate and streamline the Order to Cash process, focusing on key areas like customer invoicing, accounts receivable management, payment collection, and data reporting.

Our system extracts data from invoices and automatically uploads it into your platform, minimizing errors during invoicing. AFusion also tracks outstanding debts, sends automated payment reminders to customers, and reconciles payments seamlessly, ensuring efficient cash flow management.

Additionally, our solution provides real-time reporting and data analytics, empowering businesses to optimize debt collection and maintain tighter financial control. For example, a retail client using AFusion reduced its average debt collection time by 30% within six months. Ready to transform your O2C process? Contact us today!

Previous Post

Previous Post Next Post

Next Post