Resources > Blog > 34> Business process outsourcing for procure-to-pay

Business Process Outsourcing

For Procure-To-Pay

What is BPO?

BPO stands for Business Process Outsourcing, which means outsourcing business processes. It refers to a company delegating a portion of its operations to another entity to perform.

The original organization is called the client (client organization), while the entity tasked with the work is known as the outsourcing service provider. Instead of handling the tasks internally, the company entrusts them to external service providers with the goals of optimizing costs, improving efficiency, and focusing on core activities.

What is P2P?

The Procure-to-Pay (P2P) process is the procurement and payment process within a business. In other words, P2P is how an organization acquires the goods and services necessary to run its operations. It is a financial management process that connects the procurement and accounting departments, tracking the entire lifecycle of a purchase transaction—from identifying the need to completing the payment.

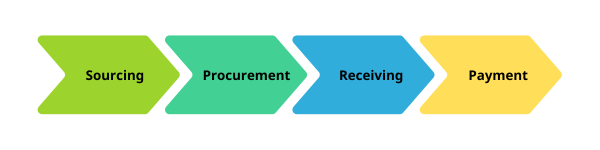

Key Activities in the P2P Procurement Process:

- Sourcing: Identifying and selecting suppliers.

- Procurement: Purchasing goods or services.

- Receiving: Accepting the delivery of goods or services.

- Payment: Settling invoices and completing transactions.

The Payment step (also known as the Accounts Payable or AP process) is the most commonly outsourced activity. This process is typically managed by the Finance & Accounting (F&A) department, making it part of financial and accounting outsourcing (F&A outsourcing).

Some companies also outsource Sourcing and Procurement, which usually fall under the Procurement or Supply Chain department, thus classified as procurement outsourcing.

The Receiving step, managed by the end-user department or warehouse (Store function), requires a physical presence at the client organization and is therefore rarely outsourced to BPO service providers.

The Accounts Payable process is one of the most frequently outsourced financial and accounting processes. The primary reason is that it handles a large volume of documents and transactions. Outsourcing this process reduces the workload on the F&A team, allowing them to focus on more critical areas.

Outsourcing the Procure-to-Pay (P2P): Reasons and Drivers

Initially, outsourcing services gained traction in the manufacturing sector, where companies collaborated with multiple suppliers to perform various tasks. This prevalence stemmed from the industry’s complex supply chains, requiring numerous suppliers to provide raw materials, components, or handle different stages of the production process.

For example, a large computer manufacturing company might outsource invoice processing to optimize its accounts payable, enabling the accounting team to verify POs and GRNs, process payments on time, and generate debt reports.

Over time, outsourcing expanded to service industries like banking, healthcare, and hospitality. In the 1990s, major corporations began prioritizing core, strategic activities to gain a competitive edge amid rapid globalization. They tended to outsource non-core processes, including procurement, fueling the growth of the Business Process Outsourcing (BPO) industry.

Businesses, from SMEs to large corporations, increasingly outsource P2P functions such as inventory management, logistics, and e-procurement, driven by AI and automation technologies. The P2P market thrives due to affordable skilled labor in countries like India, the Philippines, and Vietnam, alongside cloud-based procurement and payment solutions. The need to control inventory is also a key driver.

By category, inventory management holds a significant market share due to its critical role throughout the procurement lifecycle. Similarly, logistics, customer service, and BPO remain vital components of this ecosystem. P2P is shaping the future of corporate financial management! (Globe Newswire, 2024)

Benefits of Outsourcing the Procure-to-Pay (P2P)

Why are businesses willing to pay an external organization to handle tasks they could perform internally?

The primary reason is to improve service quality at a lower cost. When a specialized service provider handles a task, the efficiency and performance of that task are significantly enhanced.

Additionally, BPO for Procure-to-Pay offers several other benefits:

- Improved Supplier Satisfaction: An efficiently outsourced P2P process ensures suppliers are paid on time, encouraging continued collaboration and potentially better commercial terms.

- Stronger Internal Controls: Service providers can implement robust control mechanisms to prevent errors and financial fraud.

- Enhanced Data Quality: Accurate reporting from service providers gives leadership clearer insights into procurement processes and cash flow management.

- Process Standardization: In multinational companies, P2P processes may vary across regions. Outsourcing standardizes and simplifies these processes for better management efficiency.

- Optimized Practices: With specialized expertise, service providers can advise businesses on improving and redesigning Procure-to-Pay for maximum efficiency.

- Focus on Core Activities: Outsourcing P2P frees up management to concentrate on strategic, value-adding activities.

- Leveraging Time Zones: If the service provider operates in a different time zone, businesses can benefit from faster transaction processing and response times.

Thanks to these advantages, more companies are opting to outsource their P2P processes to optimize performance, reduce costs, and enhance competitiveness.For example, tasks arising during a workday in New York could be processed during the workday in India (9.5 hours ahead). The completed work can be returned to the U.S. before the next workday begins, shortening processing times.

Overall, outsourcing P2P reduces transaction costs and delivers higher-quality services to both clients and their suppliers.

Future Trends - Procurement Process Outsourcing

Another key future trend in Procure-to-Pay is the focus on improving data quality and fostering sustainable supplier relationships. Modern P2P outsourcing services enable businesses to manage procurement data more accurately—from invoice scanning and order processing to spend tracking—enhancing the reliability of financial decisions. This not only boosts supplier satisfaction but also allows internal staff to work more efficiently, alleviating the burden of manual tasks.

Furthermore, the rise of specialized P2P service providers worldwide is creating opportunities for investors while driving competition and innovation in the industry. The P2P procurement process will also play a vital role in ensuring regulatory compliance, enhancing strategic decision-making, and building long-term partnerships, promising a robust and sustainable future for this market.

Previous Post

Previous Post Next Post

Next Post