Resources > Blog > 23> Automation: Overcoming the limitations of 3 way matching in AP

Automation: Overcoming the limitations of 3 way matching in AP

In the field of accounts payable (AP) management, repetitive manual tasks are among the most concerning issues as they hinder much of a company’s potential. This is also a challenging issue for accountants when handling massive volumes of invoices before monthly supplier payments. According to the Association of Certified Fraud Examiners (ACFE), younger businesses may face invoice fraud risks more than twice as high as experienced enterprises. Additionally, companies incur further losses because after being defrauded, they still have to pay the legitimate supplier. To mitigate the risks posed by invoice fraud, a new method has been employed — three-way matching to verify document validity. However, when performed manually, this method still raises concerns regarding time, costs, and manpower, which automation can effectively address.

Manual 3 way matching process in Accounts Payable:

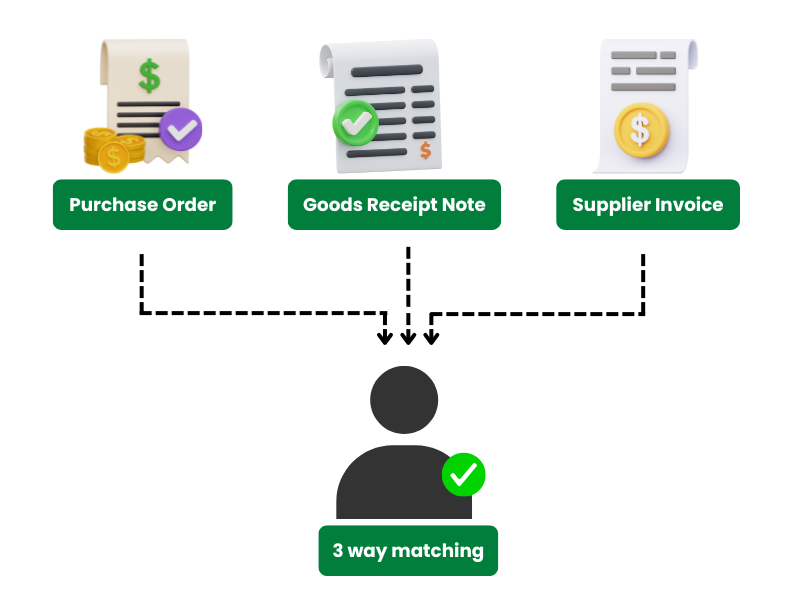

Reconciling three key documents in the manual process is conducted as follows:

- Purchase Order (PO): This document records detailed transactions between two companies, including information on prices, quantities, product types, etc.

- Goods Receipt Note (GRN): Created upon receiving goods to verify the quantity and quality of delivered items.

- Supplier Invoice: Records transaction details.

In the 3 way matching process, AP accountants must thoroughly check prices and received quantities and compare information across the three documents. Consistency among all three documents is required before making supplier payments. The goal is to confirm the goods received are correct and prevent fraudulent payments. The manual 3 way matching process remains problematic, and automation could help reduce human error, save costs, and minimize labor requirements.

Issues with manual 3 way matching in Accounts Payable

Human error

Performing 3 way matching manually is prone to errors such as incorrect data entry, document loss, or overlooked discrepancies. These errors delay payment processes, damage supplier relationships, and may lead to legal issues due to late payments. According to the Institute of Finance and Management (IOFM), manual invoice processing error rates range from 8-12%. This can result in inaccurate payments and unnecessary costs. Despite repeated quality checks by accountants, typos or misinformation can still occur due to lack of focus. A single extra digit or wrong word can lead to severe consequences. According to Gartner, poor data quality costs organizations an average of $12.9 million annually, which is not a problem to overlook.

Time and resource wastage

Thoroughly verifying every detail in purchase orders, goods receipts, and supplier invoices during manual 3 way matching is highly time-consuming. It also requires continuous coordination between accounting, warehouse, and HR departments to ensure data consistency. This slows down processes if any department encounters issues. McKinsey reports that 80% of company time is spent on repetitive data-matching tasks. For example, delayed goods receipt updates or incorrect invoice units slow down verification, delaying payments and affecting supplier relationships and credibility.

Manual three way matching not only prolongs data processing but incurs substantial opportunity costs, such as missed early payment discounts and reduced focus on strategic tasks. This diminishes overall business efficiency.

High opportunity costs

According to Ardent Partners, the average cost to manually process an invoice is $9.25, while automation solutions cost around $2-5 per invoice. Businesses may miss early payment discounts or face overpayments or underpayments due to invoice discrepancies. Early payments can secure 1-2% invoice discounts, but late payments result in lost financial opportunities.

Audit pressure

Inefficient document management complicates audit preparations, increasing the risk of regulatory non-compliance. Companies relying on manual processes often struggle with document storage, violating audit and financial management regulations. Automating three way matching in accounts payable reduces burdens on accountants, saves time and money, detects fraud, and allows AP staff to focus on higher-value projects, making automation a comprehensive solution for businesses.

Automating 3 way matching in Accounts Payable: A comprehensive solution for enterprises

Transitioning from manual to automated processes offers numerous benefits, from increased accuracy and reduced costs to enhanced operational efficiency. Automation helps organizations capture early payment discounts and avoid late fees. How can 3 way matching in accounts payable be more efficient?

Eliminate human error completely

Automated systems rapidly and accurately match purchase orders, goods receipts, and invoices. All documents are verified within seconds, completely eliminating human error. With AFusion’s iAutobot automation solution, we can process 900-1000 invoices/day with near-total accuracy, increasing accounting productivity by 30% and saving 80% of manual AP data entry time.

Save time and costs

Automation solutions enable businesses to store and process documents online, automating the entire 3 way matching process. This conserves resources, secures early payment discounts, and avoids penalty fees. Gartner predicts that by 2024, organizations will reduce operational costs by 30% by combining hyper-automation technologies with redesigned processes, yielding significant financial benefits, especially for businesses handling large invoice volumes monthly.

Detect and prevent fraud effectively

Automated 3 way matching systems can analyze data and identify anomalies, preventing fraud at the initial comparison stage. According to ACFE, typical fraud schemes last about 12 months before detection, causing substantial financial losses, averaging 5% of annual revenue. However, AFusion’s automation solutions significantly mitigate such losses. Effective 3 way matching processes can even detect potential fraud, as not all suppliers operate transparently.

Easy management and scalability

Thanks to intelligent and precise data processing, automation systems facilitate audit preparations, ensure faster and more transparent data retrieval, and comply with legal standards. Automation improves document accessibility, reduces risks of data theft or loss, and enhances document readiness.

Strengthen supplier relationships

Automating invoice processing strengthens supplier-business relationships and enhances transaction credibility. Accurate, timely transactions foster supplier trust, ensuring smooth supply chain operations and fostering long-term collaboration. Automation reduces payment disputes, a common source of tension between businesses and suppliers, allowing both parties to focus on sustainable business relationships and new projects.

Automate 3 way matching with AFusion's accounting software

Contact AFusion today to explore how businesses optimize 3 way matching in accounts payable. While matching may seem simple, manual processes are time-consuming, especially with discrepancies requiring further investigation. Reach out now to discover AFusion’s solutions for partner enterprises.

Automating three way matching in accounts payable frees employees from repetitive tasks and quickly flags fraudulent invoice signs, saving 50% costs of manual processes. Businesses can save tens of thousands of dollars annually by reducing invoice processing costs and boosting productivity.

Previous Post

Previous Post Next Post

Next Post